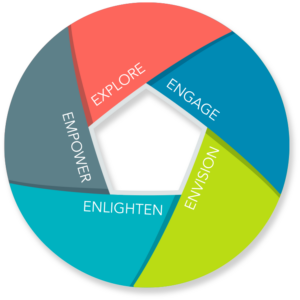

5-E Financial Life Planning Process and Stages

Our research-based 5-E Financial Life Planning Process creates a foundation for meaningful dialogue and provides a robust model for delivering personalized financial advice that strengthens client relationship and differentiates you in the market place.

There are five stages to this process: Explore, Engage, Envision, Enlighten, and Empower. Each stage is designed to facilitate an effective communication cycle and support successful client engagements.

Explore Stage

Develop and strengthen trust by establishing and demonstrating the importance of understanding your clients’ values and priorities.

Engage Stage

Facilitate a discovery process that will engage your clients’ hearts and minds while also providing important insights regarding each person’s unique frame of reference.

Envision Stage

Assist your clients in developing a vision of the future that will inspire enthusiasm and lay the foundation for meaningful life and financial goals.

Enlighten Stage

Present your financial plan and advice in a way that communicates an understanding of your clients’ concerns, interests, and aspirations while effectively linking financial strategies to their life goals.

Empower Stage

Utilize proven strategies for keeping your clients engaged, motivated, and on the path to achieving their financial goals.

The MQ 5-E Process is an example of a Virtuous Cycle:

1. A process or practice that is strengthened by its results.

2. A loop of actions or events whereby results allow the loop to be repeated with ever increasing results. It is associated with self-reinforcing practices and processes that gain strength from their outputs.

simplicable.com

Alignment with 6-Step FP Process

In addition, the MQ 5-E Financial Life Planning Process can be viewed in a linear format to show how each stage facilitates and enhances the 6-step financial planning process as defined by the Certified Financial Planner Board of Standards, Inc.

The Standards of Professional Conduct define financial planning as “the process of determining whether and how an individual can meet life goals through the proper management of financial resources. Financial planning integrates the financial planning process with the financial planning subject areas.” There are 6 steps to the financial planning process:

Establishing and defining the client-planner relationship

Gathering client data including goals

Analyzing and evaluating the client’s current financial status

Developing and presenting recommendations and/or alternatives

Implementing the recommendations

Monitoring the recommendations

Certified Financial Planner Board of Standards, Inc.

Tools & Materials

MQ client meeting tools and educational materials will elevate your value proposition and differentiate you in the marketplace. These resources are evidence-based and will provide you with the foundation for a truly life-centered practice that is characterized by meaningful client communications and successful, long-term relationships.

In addition, the breadth of the MQ suite of discovery tools will facilitate your understanding of each client’s relationship with money as well as the set of values, attitudes, and beliefs that shape their unique frames of reference. This knowledge and insight will indicate how to tailor your financial advice to each client’s needs, expectations, and aspirations.

To this end, the MQ 5-E Financial Life Planning tools and process will guide and structure your qualitative inquiry in four key areas: Satisfaction and Values, Biography, Transitions, and Goals:

Satisfaction and Values

The first step to making positive change in any area of life is awareness. Therefore, the MQ client materials in the Satisfaction and Values category enable planners to help their clients think about and assess their own levels of financial and life satisfaction while also identifying and clarifying their values. Understanding your clients' values and helping them to assess their satisfaction in various facets of life is crucial in developing successful financial plans

Biography

MQ client materials in the Biography category help you to gather information about your clients' past and present lives that will give you clues concerning the experiences that consciously and/or subconsciously influence their current financial beliefs and behaviors. Important biographical data include family and work histories, current family circumstances and responsibilities, current life transitions, and likely future life transitions. Additionally, biographical questions will expand your understanding of your clients' fears, concerns, values, priorities, plans, and dreams.

Transitions

Because nearly all of life’s transitions have a financial tether, it is important to understand that making successful transitions requires both practical strategies and emotional fortitude. From a practical standpoint, financial resilience requires a foundation of basic financial knowledge and a strategy for building financial security. From an emotional standpoint, financial resilience requires self-confidence. MQ client materials in the Transitions category will help your clients to reflect on how they have dealt with transitions in the past, assist them in managing current transitions, and aid them in planning for transitions they are anticipating in the future.

Goals

Setting goals is a method of anticipating, planning, and preparing for the future. However, until your clients are able to specify what they want and why they want it, the goals they set will be ineffective in motivating positive change. If you, as a Financial Life Planner, facilitate a meaningful goal-setting process, your clients will be intrinsically motivated to pursue the life and financial goals that they establish. The MQ materials in the Goals category are designed to help your clients adopt a fresh perspective on goal-setting and to align their visions of the future with their personal values and priorities.

“Fundamentals” Training

“Fundamentals” Training

The purpose of the "Fundamentals of Financial Life Planning" training course is to provide participants with a thorough overview of Money Quotient's unique model of life-centered financial planning. Included in this 3-day seminar is an introduction to our philosophical foundation and the academic theories that have shaped the development of our tools and training. In addition, we provide invaluable hands-on experience with the full suite of MQ materials and facilitate important discussions regarding implementation and related practice management issues.

A key objective of the Money Quotient "Fundamentals of Financial Life Planning" training is to expand the participants' knowledge of the MQ materials and to increase their understanding of how to use these tools in creating a unique and purposeful client meeting process. Therefore, completion of the three-day “Fundamentals of Financial Life Planning” training course is a prerequisite to accessing the Money Quotient materials and benefits included in Partnership Levels 2 through 4. For more details, click here

Partner Agreement Information

Money Quotient offers four different options for acquiring True Wealth™ Planning materials. Each MQ Partnership Level represents a package of tools and benefits, and each successive Level offers an increasing number of tools and benefits:

Sampler Level: Sampler

Silver Level: In-Depth Data Gathering

Gold Level: In-Depth Data Gathering & Goal Setting

Platinum Level: Complete True Wealth™ Planning Toolkit

Diamond Level: All Inclusive True Wealth™ Planning Package

Sampler Level, can be acquired prior to attending Money Quotient’s “Fundamentals of True Wealth™ Planning” (FTWP) training course. This package is available on a short-term basis only (three months) to provide you the opportunity to “test drive” MQ materials and processes prior to investing in our more in-depth programs.

Silver, Gold, and Platinum Levels are only available for Partners following completion of the FTWP training course. An important feature of our Partner structure is that, once you have completed the FTWP course, you can move up the Partnership Levels one by one or you can immediately advance to Platinum Level. Either way, the cost to you will be the same.

In addition, we offer a selection of Additional Modules that can be added to your Money Quotient Partnership to support your life-centered, values-based practice. All are designed to enhance your 1) client communication strategies, 2) relationship building activities, 3) education initiatives, and 4) marketing efforts.

* Sampler Level is designed for sampling purposes only and is made available for a testing period of 3 months.

** Completion of the “Fundamentals of Financial Life Planning” training course is a prerequisite for Partnership Silver, Gold, and Platinum Levels.

# 25% discount on monthly fees for 2-3 advisors, 35% discount for 4-10 advisors. For more than 10 advisors, contact Money Quotient.

For a complete list of tools, resources, and benefits included in each MQ Partnership Levels, please refer to the document titled, “Overview of MQ Materials & Services” (click here).