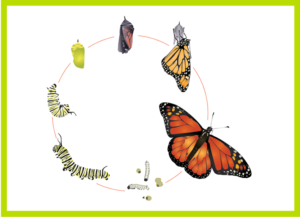

The concept of retirement is undergoing a metamorphosis. Demographic, societal, and workplace trends have all converged to offer a stage of life that is much more fluid and flexible than what most of us previously imagined. In fact, retirement has become a matter of personal definition.

The concept of retirement is undergoing a metamorphosis. Demographic, societal, and workplace trends have all converged to offer a stage of life that is much more fluid and flexible than what most of us previously imagined. In fact, retirement has become a matter of personal definition.

Adding fuel to the fire of retirement reformation is the aging of the Baby Boomer generation. Because of its sheer size and collective force of personality, the influence of this generation has been nothing short of phenomenal. Just as Boomers have redefined every stage of their lives, so too they will redefine aging and retirement.

Therefore, it is important for all financial professionals to keep abreast of trends and attitudes that will influence their clients’ perceptions of retirement and how they prepare for this stage of life. One excellent resource is What Is “Retirement”?—an extensive report based on a 2019 survey conducted by the Transamerica Center for Retirement Studies. It explores the meaning of retirement and examines the attitudes and behaviors of all three generations currently represented in the workforce:

Baby Boomer: Born 1946–1964

Generation X: Born 1965–1978

Millennial: Born 1979–2000

Increasing Longevity

Since the turn of the last century, improved nutrition and advances in medicine and healthcare have added 30 years to our average life expectancy. Without question, this is a remarkable achievement, but one that also requires each of us to think differently about life at midlife and beyond and how we choose to live our lives.

People have the potential to live longer than any other time in history. This gift of extra time requires that we fundamentally redefine retirement and our life journeys leading up to it.

What is “Retirement’?

Transamerica Center for Retirement Studies

In selecting from a series of words associated with retirement, Baby Boomer, Generation X, and Millennial respondents alike cited “freedom,” “enjoyment,” and “stress-free” as their top picks. However, despite this shared vision of retirement, the researchers emphasized that challenges lie ahead for all generations as they approach and transition into their retirement years:

The retirement landscape is ever-evolving as a result of increases in longevity, the dynamic nature of the workforce and employment trends, the transformation of employer-sponsored retirement benefits, and potential reforms to Social Security benefits.

The Role of “Work”

Not only are concepts of old age changing, but individuals are increasingly rejecting the notion that retirement is synonymous with leisure. That’s because retirement for Boomers, Gen Xers, and Millennials has come to mean emancipation—freedom to do the kind of work (paid or unpaid) they find most meaningful.

Across all three generations, survey results indicated that workers are looking forward to an active phase in life that includes continued work and time for leisure activities including travel, spending more time with family and friends, pursuing hobbies, and volunteer work. As a result, many envision a flexible transition into retirement that differs from prior generations when retirement was marked by an abrupt stop to work.

...many envision a flexible transition into retirement that differs from prior generations when retirement was marked by an abrupt stop to work. Click To TweetFor example, a majority of Baby Boomers (69 percent) either expect to work or are already working past age 65. Similarly, Generation X workers (57 percent) expect to work past age 65 or to not retire at all. In contrast, a majority of Millennials (58 percent) plan to retire at 65 or sooner. Among workers who are working or plan to work past age 65, 80 percent cited financial reasons and 72 percent cited healthy-aging reasons. The top financial reason was for the income (53 percent), while the top healthy-aging reason was to be active (47 percent).

Retirement Preparation Myopia

Although all three generations expressed a positive vision of retirement, they also communicated concerns related to financial security and declining health. In addition, despite the fact that a majority of the respondents expect to extend their work lives beyond age 65, few are adequately preparing by focusing on their health and keeping their job skills up-to-date.

The authors of the study also cited infrequency of talking about retirement as a major concern. They described this major life transition as “a family matter that calls for important conversations.” For example, nearly one-third of Generation X (31 percent) and Baby Boomers (32 percent) reported “never” discussing the topic. However, Millennials (21 percent)—the youngest generation surveyed — were the most likely to “frequently” discuss savings, investing, and planning for retirement with family and friends.

In addition, workers of all ages are increasingly expected to self-fund a greater portion of their retirement income as well as manage their own investments and associated risks. Nonetheless, across generations, only 20 percent “strongly agree” and 34 percent “somewhat agree” they are currently building a large enough retirement nest egg.

Not surprisingly, the authors of the What is “Retirement”? study concluded:

Workers must take greater action in saving, investing, financially planning - and protecting their health - to successfully transform their visions of retirement into reality.

—Carol Anderson

Note: What Is “Retirement”? explores the perspectives, attitudes, and preparations of American workers for longer lives and the meaning of “retirement.” It is based on the 19th Annual Transamerica Retirement Survey, one of the largest and longest running surveys of its kind.

Yes, indeed!!!

I presented a talk at the National FPA meeting in Minneapolis “ Transitioning from Financial Planning to Longevity Planning, Meeting the Needs of the Aging babyboomer” the video will be available from the FPA.